Lately, I’ve seen a lot of advertising imploring consumers to purchase goods through a financing option called “rent to own” or a “lease purchase” agreement. The gist of a “lease purchase” agreement is that a consumer selects the item he or she wishes to purchase. The consumer then enters into an agreement to make periodic payments for that item. Once all the payments are made, the consumer now owns the merchandise. In that respect, it is similar to a regular installment payment contract.

But, with a “rent to own” or “lease purchase” agreement, until all the payments are made, the customer has no ownership interest in the property. So, if a customer defaults on payment 34 of a 36 payment “lease purchase” agreement, the leasing company can repossess the property. To further coerce payment, some companies will take out criminal charges as reported here.

Most “rent to own” or “lease purchase” agreements state that a consumer can terminate the contract at any time by returning the property to the leasing company. The “rent to own” industry say this feature provides flexibility. But, the fact is that most people only stop making their payments because the payments are unaffordable. In a report here, Federal Trade Commission found that most folks who enter into these “lease purchase” agreements do so with the intent of making all of the payments because they want to own the property.

Rent to own agreements can be very expensive. When a comparison is made between the cost of the item purchased and the total amount paid over the life of the “lease purchase” agreement and expressed as an interest rate, the APRs for these “rent to own” agreements can range from 40% to over 150% depending on how the agreement is structured.

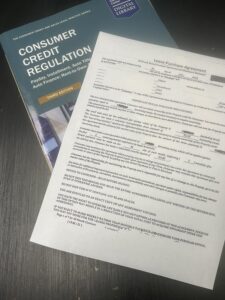

Some “rent to own” agreements may not comply fully with the applicable law in some areas. If a “rent to own” contract does not comply with the applicable law, there may be some substantial remedies available to a consumer including keeping the property without further payment as well as a return of payments made. A careful review of the contract is necessary to determine if the “lease purchase” agreement does, in fact, comply with the applicable law.

This office is happy to review “rent to own” or “lease purchase” agreements from the states in which we are licensed to practice law. Contact our office for a review.