Do I Need A Lawyer For My Bankruptcy Case?

Over the years, I’ve seen this question posted on social media sites, listservs, etc. Someone will post that his bankruptcy case went through without a problem and he did not have an attorney. And that statement may be true. But, if you are facing financial difficulties, wouldn’t you want to know how your case is likely to turn out for you? This is where an attorney experienced in bankruptcy law and practice can help you. Without a lawyer, serious trouble could be waiting.

Every Case Is Different

Bankruptcy cases are seldom routine because every case is different. Debtor A is likely to have different circumstances and different goals from Debtor B. Those different circumstances and goals are going to affect a bankruptcy case.

For example, suppose Debtor A filed a chapter 7 bankruptcy case a couple of years ago. Debtor A filed the case without an attorney. The bankruptcy trustee did not sell Debtor A’s house or car and Debtor A got a discharge from his debts. Debtor A concludes that an attorney is not necessary for bankruptcy. After all, his case went well enough.

Debtor B is considering bankruptcy. Debtor B owns a valuable classic muscle car. Debtor B does not want to lose his car. Debtor B talks to Debtor A who says his bankruptcy case went fine without an attorney. He listed in his bankruptcy paperwork everything he owned and all his creditors and that was that (according to Debtor A).

Debtor B is worried about disclosing his car. He figures if he transfers the car title to a friend (who will sign over the title to Debtor B when the bankruptcy case is over), he need not disclose the muscle car since his friend has the title and “owns” the car. Debtor B does not disclose his car ownership or the title transfer in his bankruptcy paperwork. Debtor B is excited to get rid of his debts and files his case without an attorney.

Unfortunately for Debtor B, the Trustee quickly finds out about Debtor B’s transfer of the car title. As a result, the Trustee requires the friend to give the car to the Trustee which is then sold. The money is then paid to Debtor B’s creditors. Debtor B is most disheartened by this turn of events.

But it gets worse for Debtor B. The sale of his car paid 40% of Debtor B’s debts. Since Debtor B did not disclose his transfer of the car, the bankruptcy court denied Debtor B a discharge of his debts. So, Debtor B not only lost his car, he still has a lot of remaining debt.

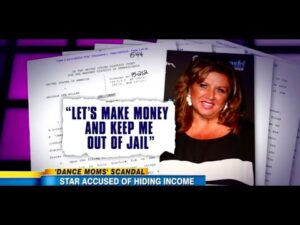

But it gets worse still for Debtor B. The bankruptcy system requires that debtors honestly and candidly disclose all of their assets, liabilities, and financial transactions. Debtor B did not do that. So, the Trustee referred Debtor B’s bankruptcy case to the U.S. Attorney for criminal prosecution for bankruptcy fraud. The maximum sentence is 5 years imprisonment and a fine. As many reality television stars have found out, bankruptcy fraud is serious!

An Experienced Attorney Can Help You Reach Your Goals

Debtor B would have done well to retain me for his bankruptcy case. Certainly, I would have advised Debtor B not to do the things he did. Since it appears that Debtor B’s car was worth more than he could exempt, a chapter 13 bankruptcy case would likely have met his goal of keeping his car and getting rid of his debt. Assuming Debtor B accurately disclosed everything and complied with the bankruptcy court’s rules, his remaining debts would be discharged. He would not be facing a possible prison sentence for bankruptcy fraud, either.

Depending on Debtor B’s financial circumstances, a chapter 7 case could also have worked. In NC, Debtor B could have exempted up to $3,500 under the motor vehicle exemption and possibly another $5,000 under his “wildcard” exemption. Usually, a chapter 7 trustee will allow a debtor to “purchase” the excess equity in an asset. So, if Debtor B could come up with enough money along with his allowed exemption, he could have gotten all of his debts discharged and still keep his car.

An experienced attorney will listen to what you wish to achieve through a bankruptcy filing. Your goals may or may not be obtainable depending on the circumstances of your case. You stand your best chance with an experienced attorney who will explain how things work. And, just as importantly, why half-baked schemes like the one Debtor B hatched won’t work.

Going it alone without an attorney is probably the biggest mistake that can be made in bankruptcy. An experienced attorney can maximize the relief available to you under the Bankruptcy Code while steering you away from schemes that could result in big trouble.